Exploring the current state and future outlook for self storage across Australasia.

Explore belowState of the Industry is the leading research report for the self storage sector, combining property, operating and people insights to explore the potential for self storage across Australasia.

The 2022 edition emerges from a post-pandemic world, showcasing the resilience and record growth of the sector in these remarkable times.

Changes in lifestyle, living spaces and severe weather events are driving record demand for self storage.

The way people are using self storage is changing, with business usage on the rise reflecting the growth in online retail and supply chain challenges.

Market conditions have enabled strong growth, with increases in both average occupancy and average storage fee rates delivering record performance in self storage and outperforming traditional asset classes.

The industry continues to mature, attracting global interest, new investment and significant levels of new supply with more than 90 new facilities in the pipeline.

After a transformational 2021 where more than $1.3 billion in self storage assets transacted, 2022 offers more stability with activity slowing and capitalisation rates stabilising in the rising interest rate environment. Macroeconomic conditions will continue to shape the sector and growth is expected to normalise in the near term.

Strong fundamentals underpin the return to stabilised growth

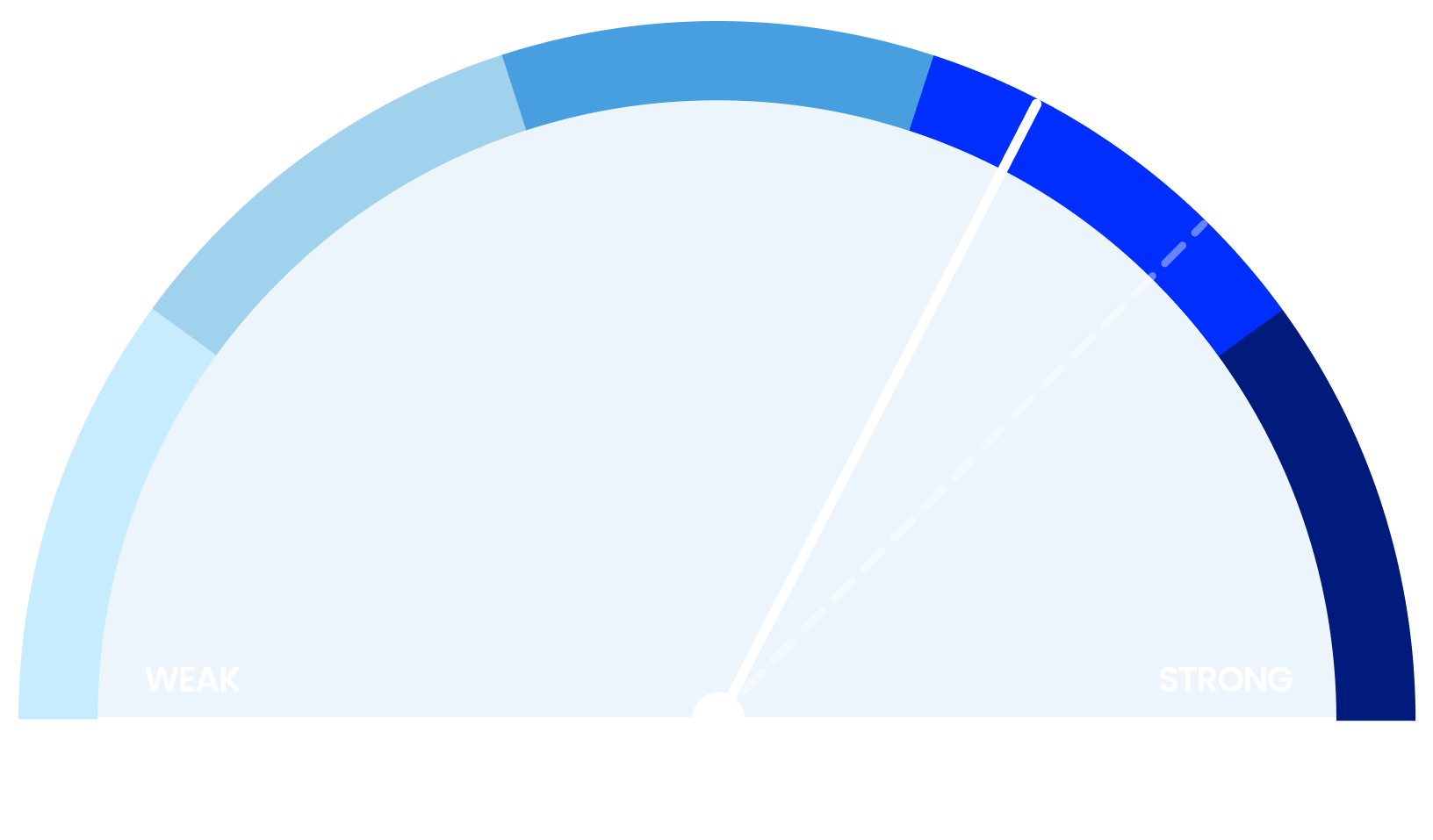

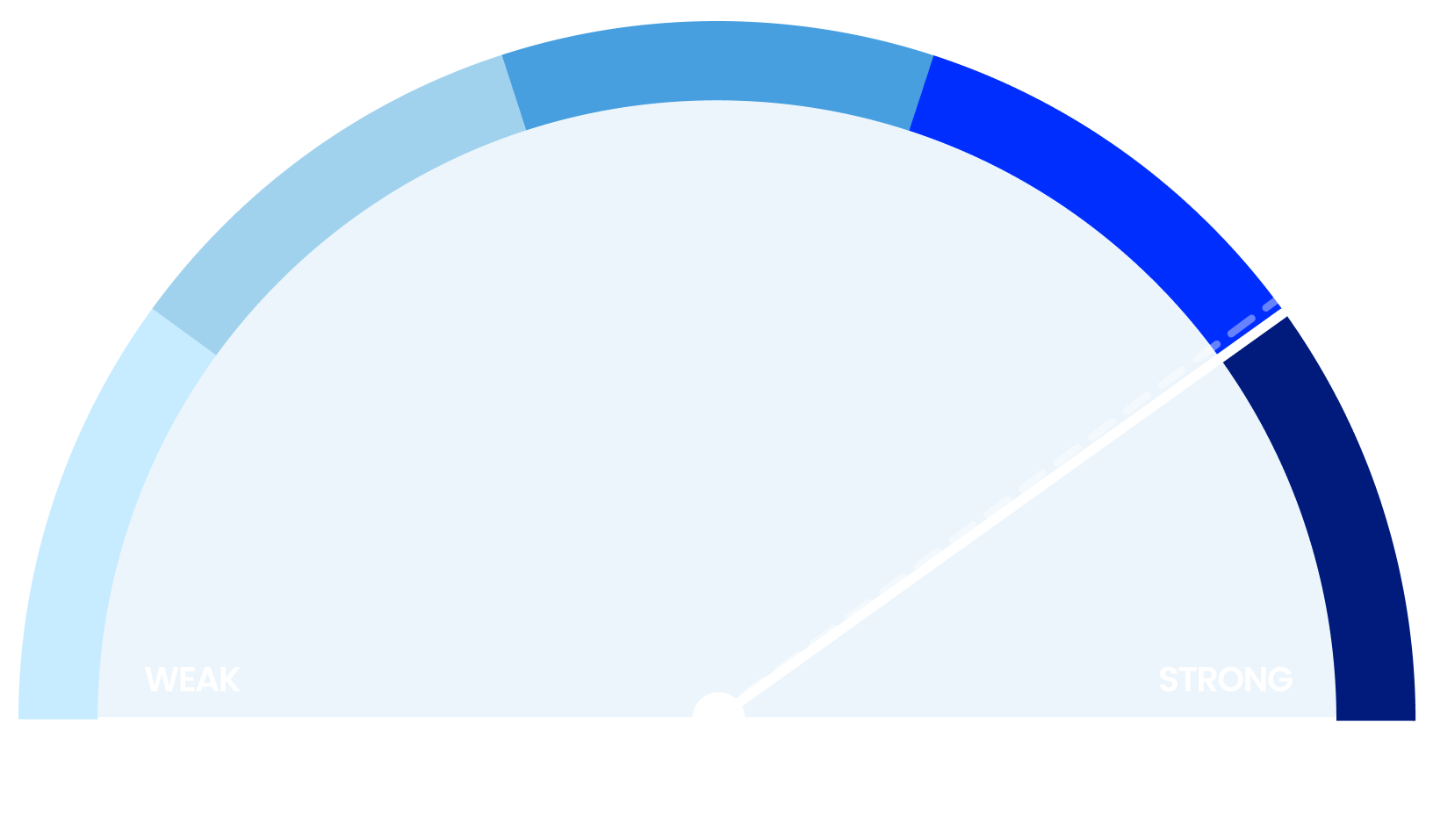

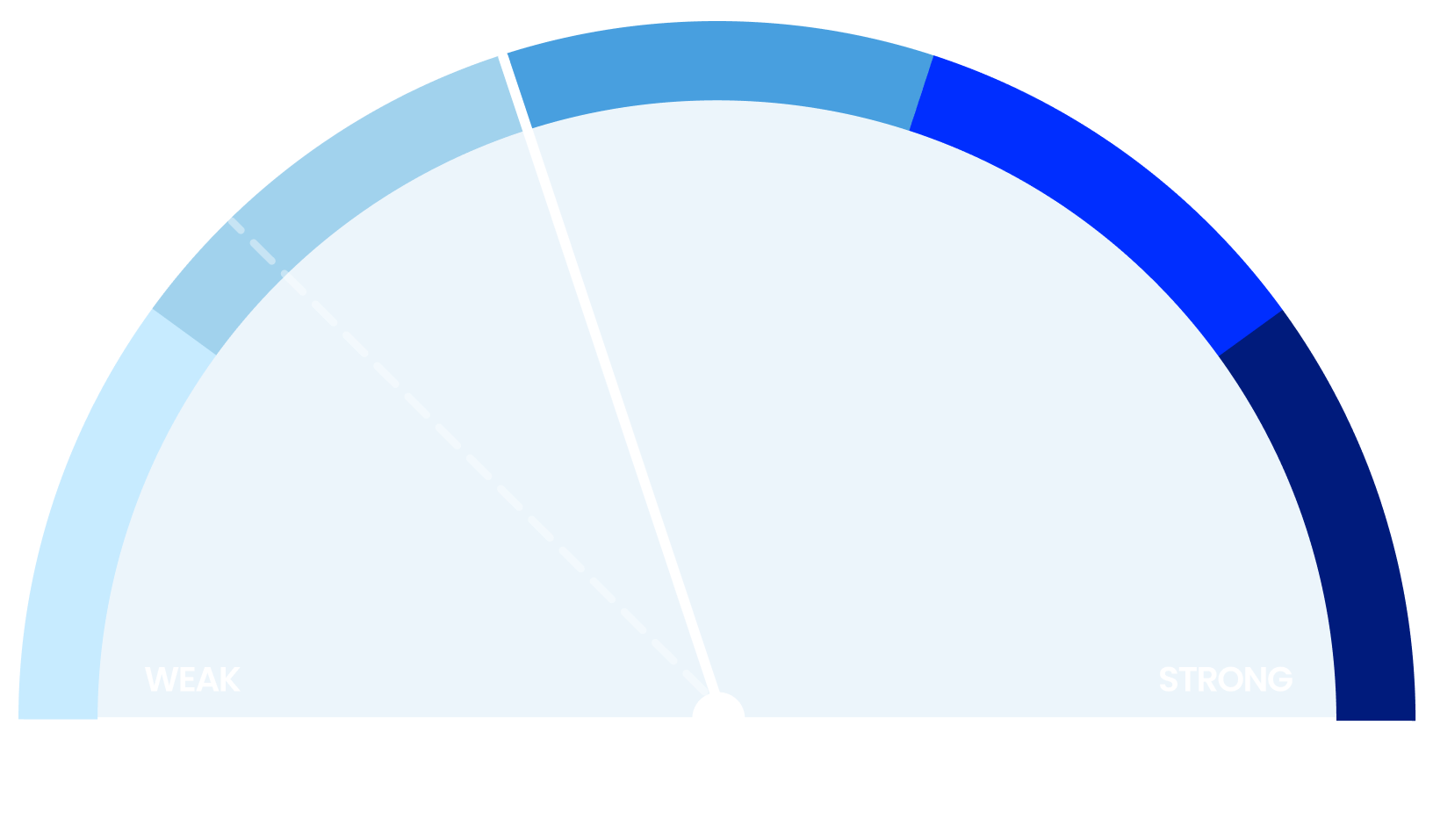

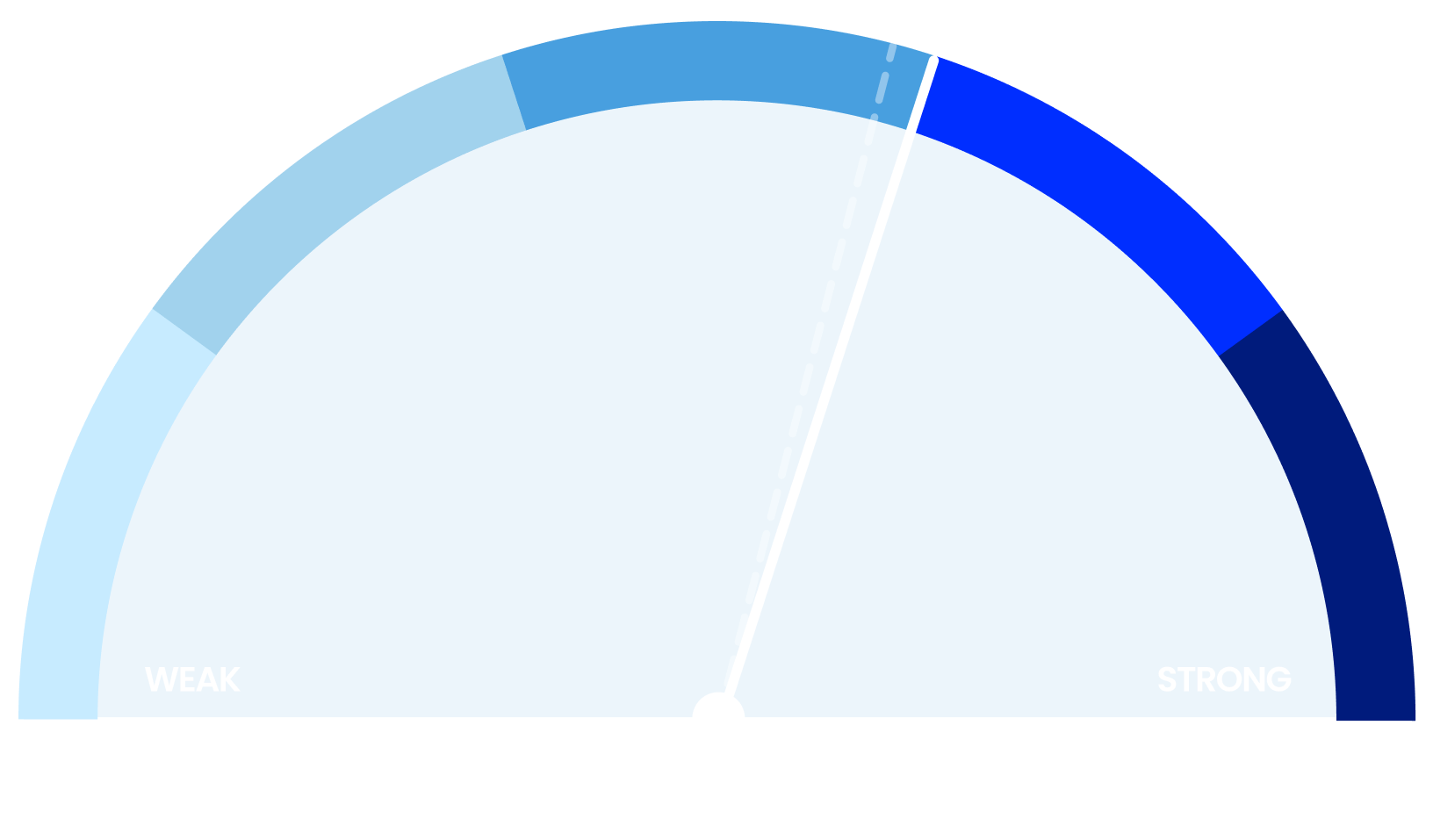

The SSAA has developed a range of trackers and indicators that measure the strength and performance of the sector over time.

In addition to a range of standalone data points, State of the Industry 2022 comprises the SSAA Macro Influence Tracker, Valuation Drivers matrix and the SSAA Storage Industry Gauge.

As the voice of industry, the SSAA believes it is important to measure and map the continued success of our sector. We are guided by our strong commitment to serving our 850+ members and supporting 2000+ self storage facilities across Australasia.

State of the Industry Partners

The ongoing support of industry makes this significant research program possible.